Report: Big Data is Accelerating Corporate Control of the Global Food Supply

Pat Mooney

Editor’s note: The International Panel of Experts on Sustainable Food Systems (IPES-Food) has just published Too Big to Feed: Exploring the Impacts of Mega-Margers, Consolidation and Concentration of Power in the Agri-Food Sector, a comprehensive (and alarming) report detailing the ways in which global agribusiness is using current economic and technological trends to further the failed industrial model. From seeds to pesticides, livestock genetics to animal pharmaceuticals, farm machinery to commodity traders, food and beverage processors to grocery stores — unprecedented consolidation has left fewer and fewer companies with a larger share of the marketplace. Meanwhile, the social, environmental and economic consequences of these unchecked arrangements are wreaking serious havoc around the world. In short, the report states, “Dominant firms have become too big to feed humanity sustainably, too big to operate on equitable terms with other food system actors, and too big to drive the types of innovation we need.” The report also explores how to build a new antitrust environment, address the root causes of consolidation and create better food systems. Below is an executive summary of the 104-page document.

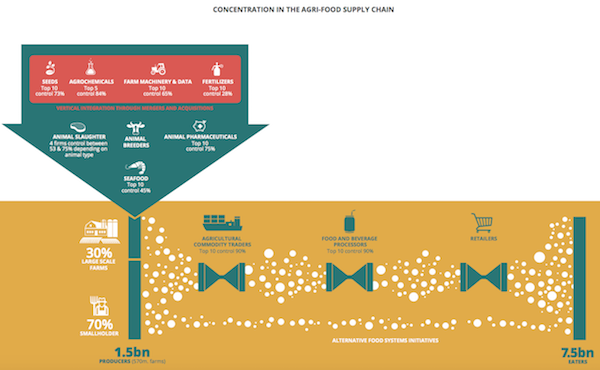

Mega-mergers are sparking unprecedented consolidation across food systems, and new data technologies represent a powerful new driver. For decades, firms in the agri-food sector have pursued mergers and acquisitions (M&A) and other forms of consolidation as part of their growth strategies. However, the recent spate of mega-mergers takes this logic to a new scale.

Since 2015, the “biggest year ever for mergers and acquisitions,” a number of high-profile deals have come onto the table in a range of agri-food sectors — often with a view to linking different nodes in the chain. These include the $130 billion merger between U.S. agro-chemical giants, Dow and DuPont, Bayer’s $66 billion buyout of Monsanto, ChemChina’s acquisition of Syngenta for $43 billion and its planned merger with Sinochem in 2018.

These deals alone will place as much as 70 percent of the agrochemical industry in the hands of only three merged companies. Meanwhile, the merger between leading Canadian fertilizer companies Potash Corp. and Agrium, Kraft-Heinz’s bid for processing giant Unilever, and online retailer Amazon’s acquisition of Whole Foods Market are proof that mega-deals are sweeping through all nodes of the chain.

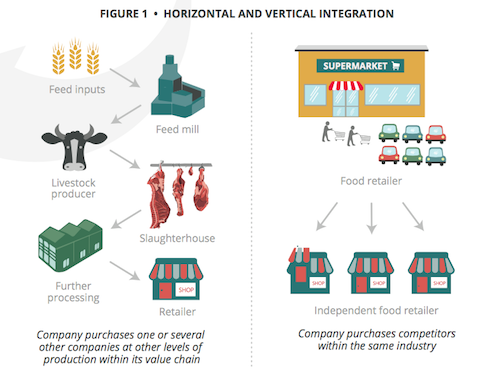

Financialization — i.e. the increasingly powerful role of financial actors, motives and trends in shaping global economic activity — has become a major driver of corporate consolidation across various sectors as investors demand higher and shorter-term payouts. However, beyond the physical (e.g. drones) and scientific (e.g. gene editing) technologies behind agri-food sector consolidation, information technology (IT) comes out as the newest and most powerful driver. Big Data connects inputs — seeds, fertilizers and chemicals — to farm equipment and retailers to consumers in unprecedented ways. A significant horizontal and vertical restructuring is underway across food systems.

(Infographic: ipes-food.org)

Rampant vertical integration is allowing companies to bring satellite data services, input provision, farm machinery and market information under one roof, transforming agriculture in the process. Mega-mergers come in the context of an already highly-consolidated agri-food industry, and are ushering in a series of structural shifts in food systems. Agrochemical companies are acquiring seed companies, paving the way for unprecedented consolidation of crop development pathways and bringing control of farming inputs into fewer hands.

The mineral-dependent and already highly concentrated fertilizer industry is seeking further integration on the back of industry overcapacity and a drop in prices; fertilizer firms are also moving to diversify and integrate their activities via hostile takeovers, joint ventures, and the buying and selling of of regional assets — with mixed results. Meanwhile, livestock and fish breeders, and animal pharmaceutical firms, are pursuing deeper integration with each other, and are fast becoming a one-stop-shop for an increasingly concentrated industrial livestock industry. Leading farm machinery companies — already possessing huge market shares — are looking to consolidate up- and down-stream, and are moving towards ownership of Big Data and artificial intelligence, furthering their control of farm-level genomic information and trending market data accessed through satellite imagery and robotics.

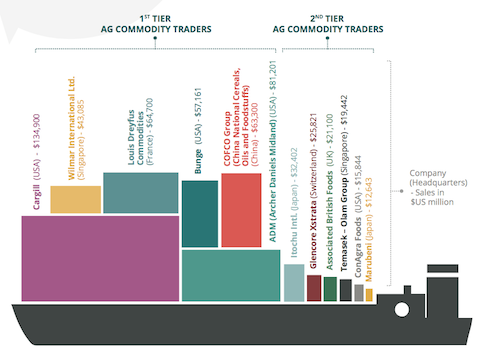

Agricultural commodity trade remains dominated by a handful of actors — including new players from emerging markets — with trading, shipping, and processing increasingly rolled together into highly-integrated operations straddling different commodity sectors and regions, and independent grain traders finding it ever more difficult to compete. Food processors and retailers, the biggest players in the system, are seeking international expansion and capturing new segments of the market to meet changing consumer demands.

Many leading processors already control the digital data for raw material sourcing, processing, marketing and delivery. They are moving upstream to better oversee their supply chains and meet quality requirements. To address changing consumer demands, they are reconstructing their images through the acquisition and creation of seemingly healthier and more sustainable brands. Retailers are moving to consolidate their position in the major markets while expanding into growth markets through further M&A activity. New actors such as Amazon are vying to harness Big Data possibilities in order to track and analyze consumer shopping habits to strengthen both in-store and online delivery systems.

The high and rapidly increasing levels of concentration in the agri-food sector reinforce the industrial food and farming model, exacerbating its social and environmental fallout and aggravating existing power imbalances. Rather than putting food systems on a path to sustainability, consolidation reinforces the logic of the industrial food and farming model — and its widespread social, environmental and economic fallout.

Consolidation also allows firms to pool economic and political capital in ways that reinforce their ability to influence decision-making on the national and international levels — and to defend the status quo. Consolidation across the agri-food industry has made farmers ever more reliant on a handful of suppliers and buyers, further squeezing their incomes and eroding their ability to choose what to grow, how to grow it, and for whom. The emergence of increasingly dominant retail and processing firms has driven concentration along the chain in order to provide the requisite scale and volume, enforcing a de facto consolidation of agriculture.

Meanwhile, upstream consolidation has left farmers hostage to a handful of suppliers and mounting commercial input costs. These trends have exacerbated existing power imbalances, allowing costs to be shifted onto farmers, squeezing their incomes, eroding their autonomy and leaving them vulnerable to unilateral sourcing shifts. Despite the supposed efficiencies of a highly-consolidated agri-food industry, consumer food prices have not been systematically reduced — and tend to rise in highly concentrated markets.

(Infographic: ipes-food.org)

The scope of research and innovation has narrowed as dominant firms have bought out the innovators and shifted resources to more defensive modes of investment. Increasing market concentration has reinforced a focus on input traits and major crops promising greater returns on investment. Companies have shifted research and development (R&D) resources to the least risky modes of investment — e.g. focused on protecting patented innovations and creating barriers to entry. Meanwhile an explosion of new product lines is providing an illusion of innovation in processing and retail, but often amounts to little more than the repackaging of existing products. Genuine innovation is emerging from start-ups, but tends to be diluted as smaller brands and companies are bought out by mega-firms.

The merry-go-round of company buyouts, boardroom turnover, and product rebranding is eroding commitments to sustainability, dissipating accountability, and opening the door to abuse and fraud. Commitments to sustainability tend to be lost as progressive CEOs are replaced and products are rebranded following mergers and buyouts. Proliferating M&A activity in food systems is also bringing financial players, e-retailers, and logistics firms to center stage in defining the trajectory of food systems — raising further questions about the prospects for building greater sustainability and accountability. Furthermore, horizontal and vertical integration is driving a reduction in seed and livestock genetic diversity, while increasing the risks of foodborne and livestock disease proliferation in increasingly centralized and homogenized systems.

The rush to control plant genomics, chemical research, farm machinery and consumer information via Big Data is driving mega-mergers — and stands to exacerbate existing power imbalances, dependencies and barriers to entry across the agri-food sector. Big Data promises major innovation and major disruption: new genomics and consumer surveillance tools could pave the way for eliminating entire links in the food chain. Access to and ownership of data often remains unclear. In this context, the data revolution could exacerbate some of the most pressing problems in food systems, including restrictions on farmers’ choices and the difficulty for innovative start-ups to access data.

Dominant firms have become too big to feed humanity sustainably, too big to operate on equitable terms with other food system actors and too big to deliver the types of innovation we need. Like the banks that by 2007 had become “too big to fail,” the emerging mega-firms have made themselves a central cog in food systems, and a major amplifier of risks — acting to reduce their own private risk at the expense of society’s and the environment’s long-term sustainability.

The agri-food giants may not be “too big to fail,” but are becoming too big to feed humanity sustainably. Consolidation is not fundamentally driven by concerns for food security, sustainability or even increased innovation — and it is not delivering these outcomes. Instead, consolidation has followed a cyclical logic, with one major merger triggering increased M&A among competitors. It has come in response to the market uncertainties which increasingly concentrated and highly financialized food systems help to drive.

Finally, consolidation has been pursued to capture new technologies or control technology “network effects” within and between sectors, as well as to maintain a system of capital accumulation and low-cost commodity supply. Consolidation may therefore succeed in these objectives, while undermining the sustainability of food systems on multiple fronts.

The world’s largest agricultural commodity traders are diversified firrms that produce, process, transport, finance and trade food and agricultural commodities (food, feed and biofuels) on a global scale. This graphic shows the top agricultural commodity trading companies in 2014. (Data source: etcgroup.org)

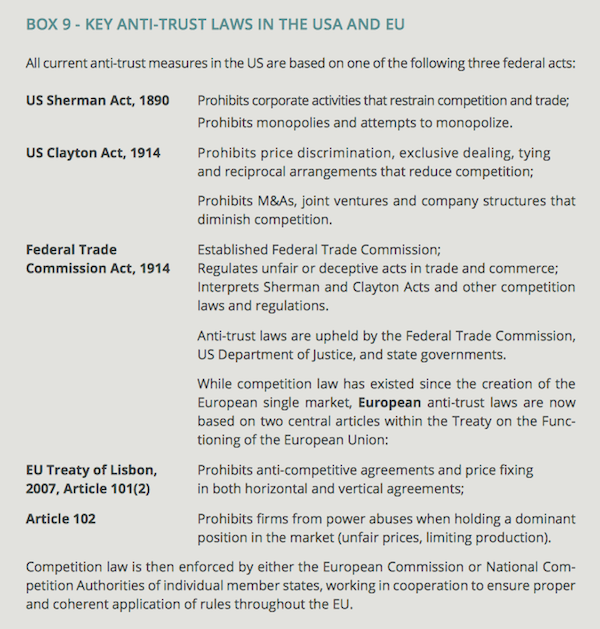

The wide-ranging impacts of mega-mergers often evade the scrutiny of regulators, but steps to redefine anti-competitive practices and extend the scope of anti-trust rules are starting to turn the tide. The narrow focus of existing anti-trust regimes on “consumer welfare” allows mega-mergers to be waved through on the basis of delivering low prices and a diversity of products to consumers. But low prices come at a high social cost, and the supposed diversity is largely illusory. Most importantly, the scrutiny of regulators typically ignores the impacts on farmers, the knock-on effects on governance (e.g. increased lobbying power), and broader implications for sustainability.

In the United States, of the 15,000 M&A deals between 2005-2014, only about 3 percent were scrutinized by antitrust regulators. According to the Organization for Economic Cooperation and Development (OECD), M&A activity in the agri-food sector faces less obstacles than ever — and may be detrimental to those already disadvantaged by agri-food industry consolidation. The tide may now be turning. Steps are being taken in a variety of jurisdictions and sectors to crack down on unfair trading practices in supply chains; to reframe the scope of anti-trust rules (e.g. by lowering the threshold of what constitutes a “dominant market share,” or by collectively addressing the “creeping concentration” of multiple M&As); and to address cross-cutting incentives and drivers of consolidation (e.g. by cracking down on firms relocating to and declaring profits in low-tax locations — “tax inversions” — and taking technology firms to task). Key entry points for addressing food system consolidation are therefore emerging, and further movement in this direction is crucial.

Steps to build a new anti-trust environment must be accompanied by measures to fundamentally realign incentives in food systems and address the root causes of consolidation. More robust anti-trust measures will not alone suffice in the face of unprecedented M&A activity, already extensive consolidation across agri-food sectors and major power imbalances that lock the status quo in place.

The incentives in food systems must be fundamentally realigned so that consolidation is no longer the prerequisite for firms to survive and thrive, so that start-ups are not automatically subsumed into mega-firms, so that food security is not contingent on a handful of firms and their proprietary data, and so that farmers and small-scale manufacturers have viable options other than to accept the terms set by multinationals in global supply chains. Steps to address the risks of industry consolidation are therefore essential steps to build sustainable food systems and must be taken regardless of whether current peaks of M&A activity are sustained.

A collaborative assessment of agri-food consolidation and a United Nations Treaty on Competition are required to deliver transnational oversight of mega-mergers. Various intergovernmental bodies should monitor the impacts of increased concentration at various levels — from farmers’ rights to decent livelihoods, and conditions on farms to the direction of technological innovation. To facilitate these assessments, sophisticated indicators of concentration need to be established, taking account of the risks of consolidated power and political influence, recognizing that food is not a commodity like any other, and capturing the risks arising from specific forms of vertical integration.

This could pave the way for measures to prohibit companies from marketing seeds whose viability and/or productivity depends on the application of a companion chemical licensed to, or controlled by that company. A subsequent and more ambitious step could see the development of a United Nations Treaty on Competition that directly addresses the differing needs and concerns of all States, building on the United Nations Conference on Trade and Development (UNCTAD) Model Law on Competition Policy and the Set of Multilaterally Agreed Equitable Control of Restrictive Business Practices.

A new “wide tech paradigm”

Given the explosion in global M&A activity, the scale of the merged entities, and the many social, environmental and economic risks it generates, the lack of an international covenant to address corporate concentration represents a major deficit. A shift towards diversied and decentralized innovation, locally applicable knowledge and open access technologies — a new “wide tech paradigm” — is urgently needed to harness the benefits of Big Data for all.

High-tech data-driven innovations can be extremely beneficial for a range of food system actors — whether to understand the spread of pests, to monitor changes in climatic conditions, or to develop new farming practices. However, as M&As increase the consolidation of data among a limited number of actors, urgent steps are required to safeguard against the excesses of highly concentrated information, and to forge more equitable conditions of access, usage and ownership.

In contrast to the current “high-tech” approach that governs knowledge and innovation, a “wide-tech” paradigm would shift the focus to diversified and decentralized innovation, locally-applicable knowledge and open access. While the innovation strategy is wide or ‘macro’, its impact is ‘micro’ and attuned to the sustainability of the immediate environment. The general embrace of high-tech approaches has meant that these other modes of innovation and exchange have received insufficient attention and have often faced obstacles in order to endure alongside the dominant knowledge and innovation paradigms.

Steps should be taken to ensure coexistence and complementarity between high-tech and wide-tech approaches. For example, some new IT companies are driving a promising shift towards crowd-sourced, non-proprietary exchanges of information and research between small producers and processors facing similar challenges around the world. In supporting this shift, it is crucial to ensure that farmers are able to shape the context in which their knowledge is collected and disseminated, and to avoid biases toward the farmers and farming systems (e.g. for export commodities) that can afford top-tier machinery and sensors.

Short supply chains, innovative distribution and exchange models — such as “solidarity economy” initiatives — must continue to circumvent, disrupt and de-consolidate mainstream supply chains, and must ultimately be supported by integrated food policies. Operating at scale and integrating different nodes of the chain have become prerequisites for sustaining the supply chains that deliver high volumes of food commodities to global markets. To resist further consolidation and counter its effects, mainstream supply chains and food distribution systems may need to be circumvented and progressively replaced by fundamentally different models. While business-led change should be encouraged, changing power dynamics within global food systems requires a diversity of actors to mobilize, new relationships to be forged between food production and consumption, and new networks of distribution and exchange to grow.

In almost every sector, new businesses are emerging to meet the “triple bottom line” of economic, environmental and social sustainability — building on the principles of social and solidarity economies, food sovereignty and community empowerment. Some of the most promising initiatives include short food supply chains, direct marketing schemes, cooperative marketing and purchasing structures, and local exchange schemes (e.g. farmers’ markets, sustainable local public procurement, community and school gardens and community supported agriculture).

In some sectors, new practices are rapidly becoming the norm (e.g. the rise of artisanal craft beer production) and are paving the way for meaningful deconsolidation. Alternative business models are disrupting food systems — if not yet transforming them — and are providing real-life examples of the benefits of a less consolidated food system: reconnecting people with food, rebuilding accountability, cementing trust without imposing homogenizing standards, reinvesting brands and products with meaningful standards, and paving the way towards a more equitable distribution of costs and value.

Allowing more diversity and alternative practices to flourish also requires stronger political support. Ultimately, it requires the development of integrated food policies to drive a sequenced shift away from industrial food systems and the highly consolidated companies and supply chains on which they rest.

(Source: ipes-food.org)

About:

The International Panel of Experts on Sustainable Food Systems is a transdisciplinary initiative working to inform the policy debate on food systems reform through evidence-based research and direct engagement with policy processes around the world. The panel is co-chaired by Olivier De Schutter (former UN Special Rapporteur on the right to food) and Olivia Yambi (nutritionist and former UNICEF representative to Kenya). The Panel brings together different disciplines and different types of knowledge, comprising environmental scientists, development economists, nutritionists, agronomists and sociologists, as well as experienced practitioners from civil society and social movements.

Editorial leads for Too Big to Feed: Exploring the Impacts of Mega-Mergers, Consolidation and Concentration of Power in the Agri-Food Sector by Chantal Clément and Nick Jacobs.

Citation: IPES-Food. 2017. Too big to feed: Exploring the impacts of mega-mergers, concentration and concentration of power in the agri-food sector.