While investigating the holders of Puerto Rico’s $74 billion in public debt, In These Times stumbled across a hidden conflict: State and local pension funds across the rest of the United States are complicit in a bid to drain money from Puerto Rico’s pension funds.

Long before Puerto Rico was devastated by two hurricanes, it was already drowning in debt and mired in the worst pension crisis in the nation. In 2008, the Employee Retirement System (ERS), which serves the island’s public-sector retirees, faced a $15 billion budget shortfall. To provide the system with much-needed cash, ERS issued just over $3 billion in bonds backed by future employer contributions to ERS, meaning that bondholders could take those contributions if ERS failed to make its interest payments.

At first, only residents of Puerto Rico could purchase the bonds, which were packaged by mutual funds like UBS and Santander and sold to Puerto Ricans saving money for college and retirement. By 2014, however, ERS was nearly out of money, and the value of the bonds plummeted, leading to a massive sell-off.

The bonds were scooped up by so-called vulture funds (also known as “distressed debt funds”) — hedge funds that act like sophisticated collections agencies, buying toxic debt at a steep discount and pursuing debtors both in and out of court to recoup their investment. Vulture funds often resort to strong-arm tactics to ensure repayment. In one infamous case, a vulture fund seized an Argentine naval frigate, holding the ship and its crew for ransom until Argentina made a $20 million debt payment.

Meanwhile, Puerto Rican retirees were suffering under an austerity regime. In 2016, Congress established a fiscal oversight board to take control of the island’s finances, and in March 2017, the board cut pension benefits by 10 percent. Even then, it was unclear whether the fund would remain solvent; retirees’ futures were uncertain.

With the pension fund drying up, the vulture funds that now own one-third of the pension system’s debt wanted to be first in line to get paid. In July 2017, eight of the funds filed a complaint in federal bankruptcy court, requesting that ERS divert employer contributions to repay bondholders, putting retirees at risk of even steeper cuts. In their filing, the funds complained that “pension beneficiaries will receive 90 percent of the amount they are owed while ERS Bondholders will receive pennies on the dollar.”

But raiding pension funds isn’t the only way vulture funds make money off of the United States’ $27-trillion retirement-savings industry. In fact, many of the vulture funds in the ERS case count municipal and state pension systems among their largest clients. Using publicly available documents, In These Times identified more than two dozen of these pension systems. Public employees from Oregon to Wisconsin to California find themselves complicit in a suit to take away pension payments from Puerto Rico’s retired teachers, firefighters and other public workers.

TRACKING DOWN THE VULTURES

The largest vulture fund in the ERS case, Oaktree Capital Management, oversees nearly $24 billion on behalf of public pension funds, and its clients include 75 of the 100 largest pension systems in the United States, at least 12 of which are directly invested in ERS bonds. Oaktree is claiming ownership of more than $410 million in ERS bonds, across seven funds.

Some of the largest pensions invested in Oaktree’s Puerto Rico-related funds include the Washington State Board of Investment, which has $600 million invested across two Oaktree funds; the North Carolina Retirement System, which has invested $190 million; the Massachusetts Pension Reserves Investment Management Board, with $175 million invested; and the Oregon Public Employees Retirement Systems, with $125 million invested.

The identities of the second and third-largest vulture funds in the ERS case initially proved a mystery. Listed in court filings as “SV Credit” and “Ocher Rose,” respectively, their names and addresses appeared in the ERS bankruptcy documents and virtually nowhere else. Neither the SEC nor the Municipal Securities Rulemaking Board (MSRB) have any record of either firm’s existence, and the addresses provided in court documents trace back to so-called corporate-services companies, which serve as frontmen for corporate entities wishing to keep their identities under wraps.

Fortunately, both firms are required to file certificates of incorporation with the Delaware Division of Corporations, where both SV Credit and Ocher Rose are incorporated. These documents provide limited information about each company, but it was enough for In These Times to track down their parent entities.

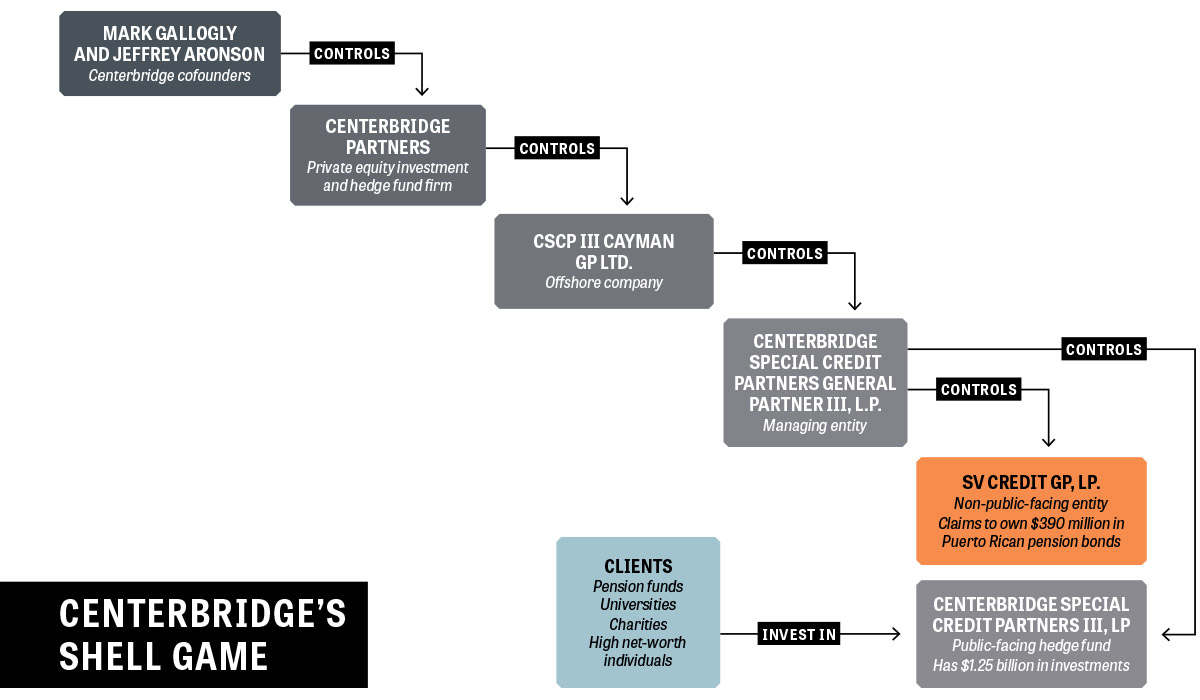

In the case of SV Credit, which owns nearly $390 million in ERS bonds, the firm’s corporate charter revealed a tangle of shell companies that all led back to one place: Centerbridge Partners, a hedge fund and private equity firm based in New York City.

The firm is run by two powerful financiers, Jeff Aronson and Mark Gallogly, who are also prominent philanthropists and political donors. In 2009, Gallogly served on President Obama’s Economic Recovery Advisory Board tasked with guiding the administration’s response to the financial crisis.

Centerbridge has more than $25 billion in assets under management, about $4.2 billion of which is invested in Centerbridge Special Credit Partners III (CSCP III), the fund that owns SV Credit. Public pensions have invested at least $987 million in CSCP III, more than half of which comes from just one pension fund alone: the Oregon Public Employees Retirement Fund, which manages more than $70 billion on behalf of Oregon’s roughly 400,000 current and retired public employees.

Ocher Rose was even more difficult to identify. Because it is registered as a limited liability company, its corporate charter only includes the name of the firm’s authorized signatory, a person with the authority to sign legal documents on the company’s behalf. Through a public records search, In These Times found a possible match for the authorized signatory’s identity: a legal administrator working for King Street Capital, another hedge fund based in New York City. Through its public relations representative, King Street confirmed that it owned Ocher Rose.

King Street, which claims $197 million in ERS bonds, operates a $12 billion vulture fund, which industry publication Hedge Fund Insight once called “the daddy of distressed funds.” The fund invests at least $499 million on behalf of public pensions, nearly half of it from the New York State and Local Retirement System.

Several of the other vulture funds in the ERS case have counted public pensions among their clients, both past and present. Glendon Capital Management, for example, has at least four public pensions invested in its Glendon Opportunities Fund, a Cayman Islands-based distressed debt fund claiming $33.7 million in ERS bonds. Mason Capital, which owns $141 million in ERS bonds, previously managed investments on behalf of both Florida and Rhode Island’s retirement systems, but both pensions pulled out due to poor returns.

DIFFUSION OF RESPONSIBILITY

The extent to which pension systems invested in these vulture funds were aware of their involvement in the ERS bankruptcy is unclear. When In These Times contacted the seven pension funds with the largest investments in the ERS case, all seven either denied responsibility for the vulture funds’ actions or declined to comment.

Only one of the seven, the Florida State Board of Administration (SBA), which has $200 million invested with King Street, indicated that they knew about their involvement in the ERS case. In a statement, their spokesperson said, “We are aware of our partner’s investments,” but added, “As with any limited partner in any fund, the SBA does not engage in any day-to-day management issues or decisions of a fund; and as a fiduciary, I am sure you understand the SBA would not comment one way or another on a manager’s actions.”

Asked if they endorsed the vulture funds’ efforts to demand payment from ERS, none of the seven pension systems explicitly condemned efforts to divert Puerto Rican public workers’ retirement funds to pay off Wall Street bonds.

In a 2016 meeting with the Oregon Investment Council, which has $625 million invested in vulture funds involved in the ERS case, Centerbridge co-founder Jeffrey Aronson did not mention Puerto Rico or ERS directly, but he emphasized that Centerbridge’s investment strategy involves fighting to claim the largest possible share of debtors’ assets, even if other stakeholders are left with crumbs.

“What we look to do in each of our investments is to target a particular class of debt and purchase enough of that debt so that we can be at the negotiating table to determine, keeping in mind the pie metaphor, how the pie will be sliced, to make sure we get the largest piece possible,” Aronson said.

The Oregon Investment Council voted unanimously to invest $500 million in Centerbridge Special Credit Partners III.

MORAL (AND ECONOMIC) HAZARDS

The investment managers who oversee public pensions may not be concerned by the vulture funds’ behavior, but many of the workers whose retirement funds they manage do not feel the same way. The Illinois Federation of Teachers (IFT), whose members belong to the Illinois Teachers’ Retirement System, which invested $100 million in Oaktree’s ERS-related fund, said in a statement that they were unaware of the investment and “would not support diverting pension benefits owed to retirees to pay off investment expenses.” IFT is an affiliate of the American Federation of Teachers, which represents teachers in Puerto Rico and has campaigned against cuts in their pension benefits.

Others have set their targets on ending public pensions’ involvement with vultures and other hedge funds altogether. Hedge Clippers is a nationwide coalition of unions and grassroots organizations that seeks to “expose how hedge funds and billionaires influence government and politics in order to expand their wealth, power and influence.”

In 2016, Hedge Clippers successfully pushed the New York City Employee Retirement System, the largest pension fund for municipal employees in the United States, to pull its investments from hedge funds. It became the second major pension fund to do so joining the California Public Employee Retirement System, which divested from hedge funds in 2014.

Hedge Clippers coalition members include the New York State United Teachers, the Communications Workers of America and the American Federation of Teachers, all of which represent public sector employees whose pension funds are invested in ERS.

In These Times contacted AFT and CWA for comment on the ERS case, as well as several state affiliates representing workers covered by pension systems invested in the ERS vulture funds. Many of the state affiliates were unable to reply by deadline, the California Federation of Teachers, many of whose members belong to the California State Teachers Retirement System (CalSTRS), which has $125 million invested in Centerbridge Special Credit Partners III, wrote:

We encourage the CalSTRS board to review their Environmental, Social and Government policies to find out if this hedge fund is consistent with those values that they have. If CalSTRS does choose to divest from this hedge fund, it should be done in a measured and orderly process for a smooth transition.

A spokesperson for CalSTRS confirmed the pension system’s investment with Centerbridge.

Both CWA and AFT’s nationals did not comment on the ERS case specifically but voiced concerns about hedge funds. CWA Communications Director Candice Johnson wrote, “CWA opposes the investment of a growing percentage of public worker pensions invested in hedge funds.” She also noted that in New Jersey, where the Public Employee Retirement System has a $100 million investment in Glendon Opportunities Fund, CWA and other unions representing New Jersey public workers “have pushed for limits on the amount of funds that can be invested in hedge funds, pointing out that this would save the pension plan hundreds of millions of dollars that now are wasted on fees and other costs.”

AFT President Randi Weingarten — who currently represents Puerto Rican teachers in the Title III bankruptcy proceedings, although she was not commenting in that capacity — condemned hedge funds that “threaten the livelihoods of workers in Puerto Rico.”

“We will continue to fight to rebuild a vibrant Puerto Rican economy and provide checks and balances on bad actors who, without scrutiny, would line their pockets to the detriment of American workers and retirees — on both the Island and the mainland,” Weingarten wrote in an email. On the issue of pension fund management, she cautioned, “If trustees choose to invest in hedge funds, they must carefully analyze costs, but also ensure workers’ interests are not being eroded to reap unjust and unearned profits.”

Julio López Varona, who helped organize the hedge fund divestment effort in New York City, says that divestment is the right decision, both morally and economically. Hedge funds charge exorbitant fees, often amounting to 20 percent of investment profits, plus a 2 percent management fee, and their investment returns are mixed at best. In fact, many of the vulture funds involved in the ERS case have underperformed the market. Oaktree’s Opportunity Fund IX, for instance, has yielded average returns of just 2 percent since its inception in 2013, while King Street has done only slightly better, with a 4.4 percent average annual return since 2011. The average annual return for stocks in the S&P 500 over that period was 12.3 percent.

López Varona, who grew up in Puerto Rico and whose mother receives a pension through ERS, says that there’s no justification for pension systems to remain invested in vulture funds. “There are other options, and those options are feasible, and people can still make money for their pensions without hurting their families back home.”

A condensed version of this article appeared in the February 2018 print edition.

This story was supported by the Leonard C. Goodman Institute for Investigative Reporting.

Sean Davis contributed fact-checking and research assistance.

ETHAN COREY is a New York-based reporter writing about politics, social movements and inequality.